Putting their children through college is high on the list of concerns for many parents. As a parent, you want to maximize your child’s odds of success, and that involves picking the school that will be a good match for his/her learning ability, ambitions and culture. But a factor of equally high importance is the cost of education. While a small number of parents are fortunate enough not having to worry about this aspect of education, for the rest of us, cost should be an essential deciding factor when it comes to picking a school.

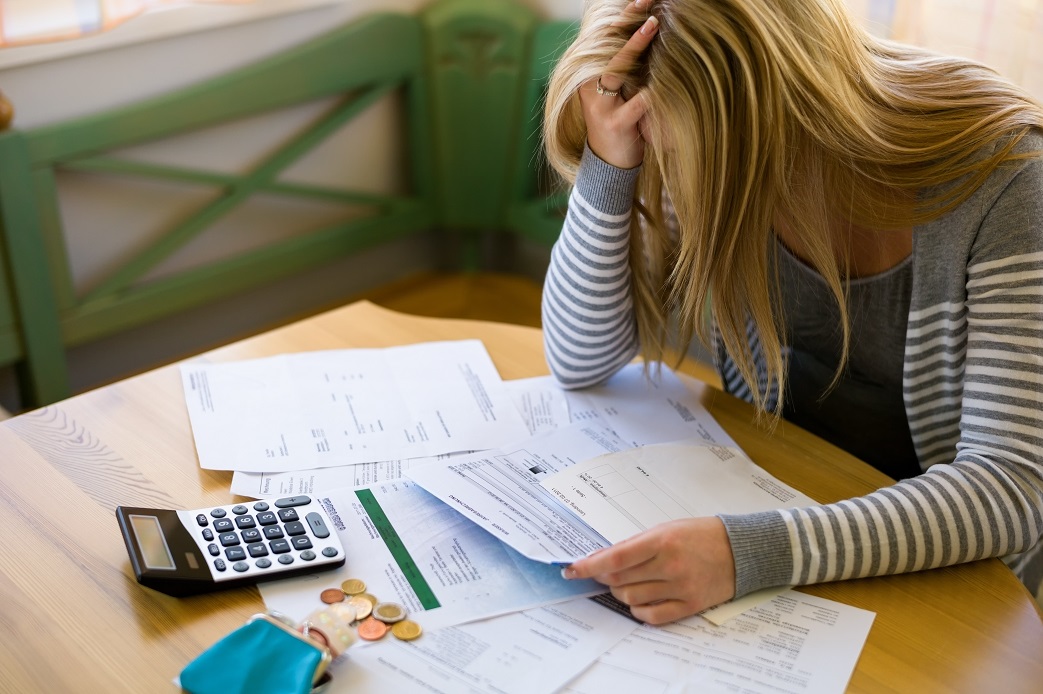

Both parents, and their young scholars often give too much importance to the role a school brand plays on the resume. It is important to recognize that for many professions a bachelors degree is not enough, and if a student is likely to opt for a masters degree, the second school’s brand will play much higher role then the first. Also, while there is some statistical advantage when looking for your first job, of having a brand name school on your resume, it is a must to recognize the trade offs in the quality of life that the student or his/her parents will make in order to afford that advantage. With school costs being as high as they are, students are likely to graduate with a very large loan, oftentimes exceeding $100,000 and going as high as $200,000, depending on family income. Paying off a loan that large, can put a lot of stress on both parents and graduates. This level of debt will affect the student’s future lifestyle for many years to come. After the learning is over, and all that reminds you of it is a diploma and a huge bill at hand, many students and their parents double question the validity of their prior ambitions.

One resource that I find helpful in making responsible financial decisions when it comes to college spend is http://prosperaftercollege.com. This site helps to visualize the effects debt will have on student’s future lifestyle. It offers a school search page to filter schools based on financial and lifestyle goals and also has a calculator intended to show what amount of debt can be comfortably taken on by the student.

I wish all students to achieve their life goals while remaining financially independent and free.